Licensing

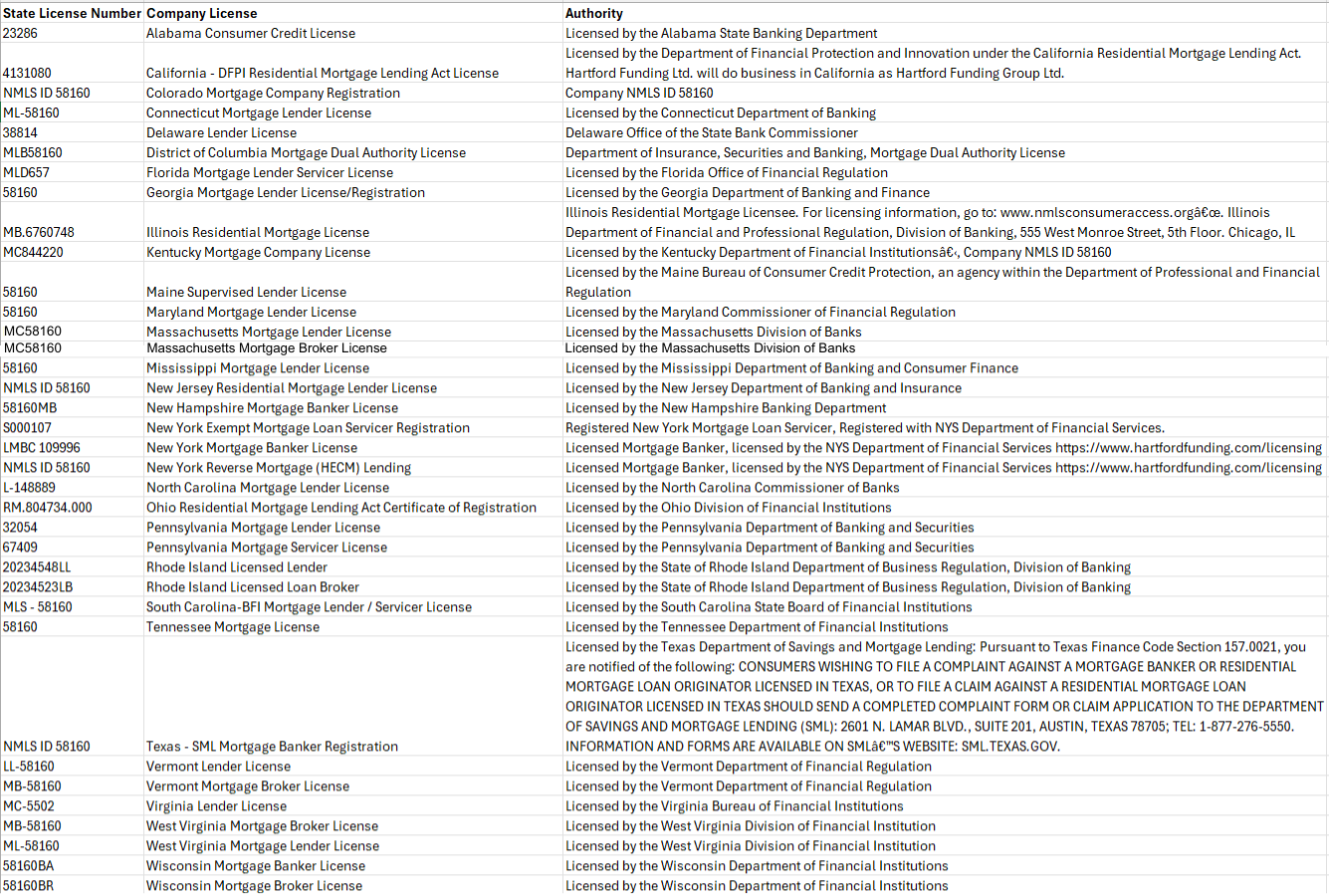

Disclosures and License Information

We are here to serve you.

HARTFORD FUNDING, LTD. 100 Crossways Park Drive West, Suite 302, Woodbury, New York 11797

Toll Free 833-238-2280

Company NMLS ID # 58160 ~ For licensing information, go to http://www.nmlsconsumeraccess.org

Hartford is a HUD approved Non-Supervised Lender; Lender ID #34502-09992.

Hartford Funding, Ltd. is a mortgage lender and is not affiliated with or acting on behalf of HUD, VA, FHA, or any agency of the federal government. Such materials are not from HUD or FHA and the document was not approved by HUD/FHA or a Government Agency. This is not a credit decision or a commitment to lend.

Hartford Funding LTD recognizes the importance of monitoring and evaluating positive and negative consumer feedback concerning the quality of the services provided by the Company, our employees, and third party service providers. The Company provides several methods by which a consumer can submit complaints concerning the Company, its employees, and/or its third party service providers. These methods include:

1. Our Contact Us page.

2. Call us toll-free at (833) 238-2280. Consumers are able to speak directly to the Consumer Complaint Manager.

3. E-mail correspondence. Consumers are able to submit their questions, concerns and complaints to the Consumer Complaint Manager by sending their e-mail to jmilana@hartfordfunding.com or to the Company’s dedicated email complaint inbox: info@hartfordfunding.com.

4. Written complaint. Consumers are able to submit their questions, concerns and complaints to the Consumer Complaint Manager by mail at 100 Crossways Park Drive West, Suite 302, Woodbury, NY 11797.

Licensed by the Texas Department of Savings and Mortgage Lending, NMLS ID 58160

Figure: 7 TAC §81.200(c)

“CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”

STATE OF ILLINOIS COMMUNITY REINVESTMENT NOTICE

The Department of Financial and Professional Regulation (Department) evaluates our performance in meeting the financial services needs of this community, including the needs of low-income to moderate-income households. The Department takes this evaluation into account when deciding on certain applications submitted by us for approval by the Department. Your involvement is encouraged. You may obtain a copy of our evaluation. You may also submit signed, written comments about our performance in meeting community financial services needs to the Department.

Hartford Funding, Ltd. is an Equal Housing Opportunity Lender and is committed to treating all applicants and borrowers in a fair and consistent manner and without regard to race, color, religion, national origin, age (provided the applicant or borrower has legal capacity to enter into a binding contract), sex, marital status, disability, familial status, receipt of public assistance, or the exercise of legal rights under the federal Consumer Credit Protection Act (15 U.S.C. §§ 1601 et seq.).

If you reside more than 50 miles from our corporate office, you may call us collect at 516-595-7600.

Important Information About Procedures For Opening a New Account:

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person and/or entity whom opens an account. (e.g., establishes a formal relationship by means of a loan application)

What this means for you: When you apply for a loan, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.